According to statistics, 80% of Americans are in debt. From auto loans to credit cards, most people have or are experiencing the crushing feeling of living under a burden of debt. Most of that debt is found in home mortgages, but student loans trails behind as the second highest category of debt. U.S. student loan debt, as of the end of 2019, has reached $1.5 trillion. This amount is owed by over 45 million borrowers.

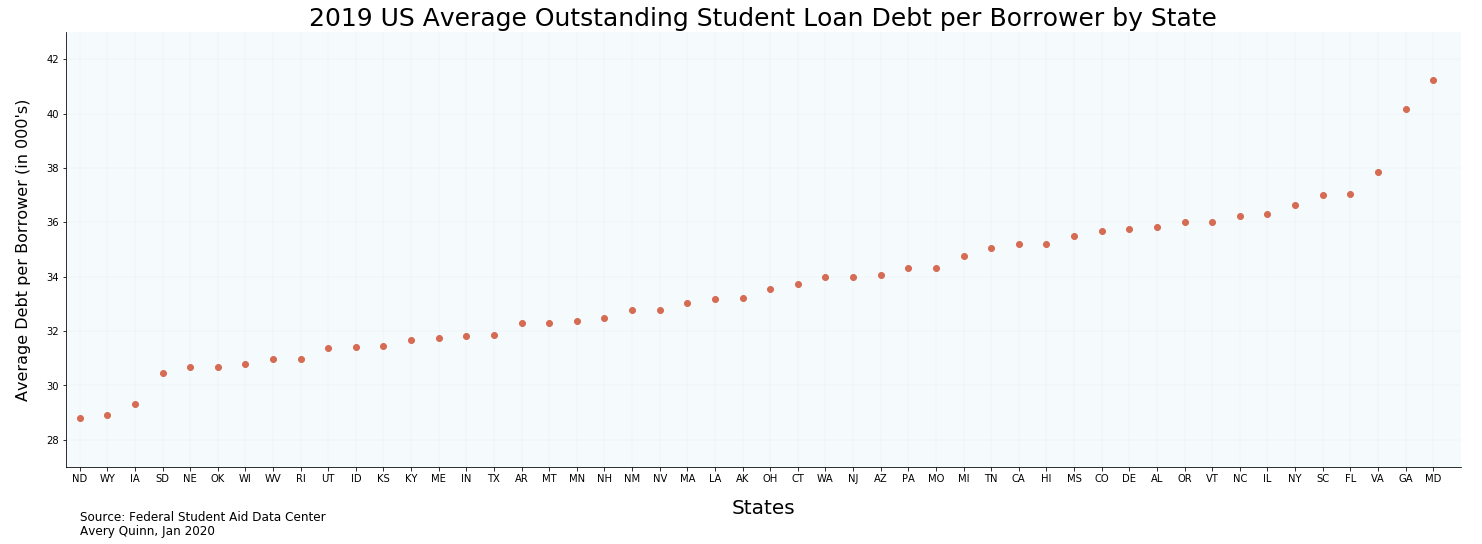

Student Loan Debt Per Borrower In The U.S. States

The average outstanding student loan debt per borrower in America is $34.6 thousand. Among all 50 states, this amount only varies slightly. Outstanding debt owed per borrower in most states fall between the range of $30–40k. The states with the lowest averages are North Dakota: $28.5k; Wyoming: $28.9k; Iowa: $29.3k; South Dakota: $30.5k; and Nebraska: $30.7k. Maryland, Georgia, Virginia, Florida, and South Carolina have the highest averages in the nation with each borrower owing an average of 41.3k, $40.2k, $37.8k, $37.1k, and $37k respectively.

Student Loan By Age Group

Looking further into the American student loan crisis, a significant difference between borrowers is more noticeable after dissecting the data by age. Here is the breakdown of the average amount owed by age.

24 and Younger: $14,766

25 to 34: $34,348

35 to 49: $45,126

50 to 61: $42,820

62 and Older: $41,471

The average amount of outstanding debt owed by individuals 24 years old and younger is much lower than any other age range. Though some of the individuals in that age range might be still in school, the amount of student loan debt owed more than doubles for borrowers just ten years older.

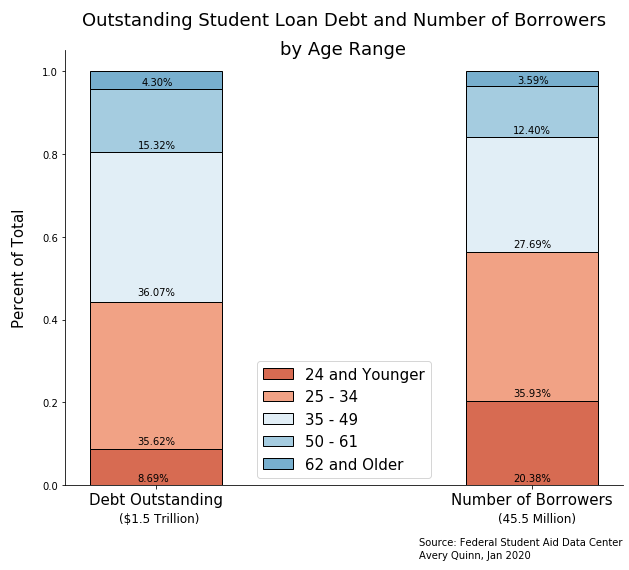

The largest concentration of student loan debt is from borrowers between the ages of 25–34 and 35–49. As illustrated in the chart below, 25–34 year olds represent 35.9% of all borrowers and owe 35.6% of the outstanding debt burden. Individuals 24 and Younger, however, represent 20.38% of all borrowers and are responsible for only 8.69% of the outstanding student loan debt.

Many things can account for this stark difference. Borrowers in the age ranges 25–34 and 35–49 may have been less informed about debt overall. With 70% of new college graduates finishing with debt, we know that traditional students are still taking out loans for school, but through the internet, blogs, videos, school counselors, and their parents, they may be more informed about options for paying for school.

Individuals in their late 20s and 30s might be also going back to school or pursuing advanced degrees that may lead them to acquire more debt. In addition, depending on the type of loan and if it’s in deferment or not, interests will start accruing. Many people, especially if they have other debts or obligations, may struggle to make their monthly payments. Loan providers estimate that it should take 10 years to pay off loans, but it takes the average borrower 21 years to pay off his or her loan. Lastly, taking out parent plus loans and optimism about forgiveness programs could also account for the large concentration of debt owed by borrowers in older age ranges.

Average Debt of Borrower 24 and Younger by State

When you look at outstanding debt from borrowers 24 years old and younger by state, a new pattern can be seen. A straight line can almost be drawn down the middle of the country. Borrowers 24 and Younger from the western states seem to owe less on average than individuals on the opposite side of the country. This distinction may be significant because when comparing the average debt of greater age ranges, this pattern diminishes.

Clearly, as these statistics show, student loan debt is still a massive problem in the United States both on the acquisition and repayment side. Many people still owe on loans well into their early 60s. Borrowing also remains a fact of life for young college students, but there may be a trend developing depending where you live in the country.

(Source for data includes: The Federal Student Aid Data Center)

~Avery Quinn